Some Ideas on Paul B Insurance You Need To Know

Wiki Article

Paul B Insurance Things To Know Before You Get This

The thought is that the cash paid out in claims gradually will certainly be less than the overall costs accumulated. You may seem like you're throwing money gone if you never submit a case, yet having piece of mind that you're covered in the event that you do suffer a considerable loss, can be worth its weight in gold.

Picture you pay $500 a year to guarantee your $200,000 house. This means you have actually paid $5,000 for home insurance policy.

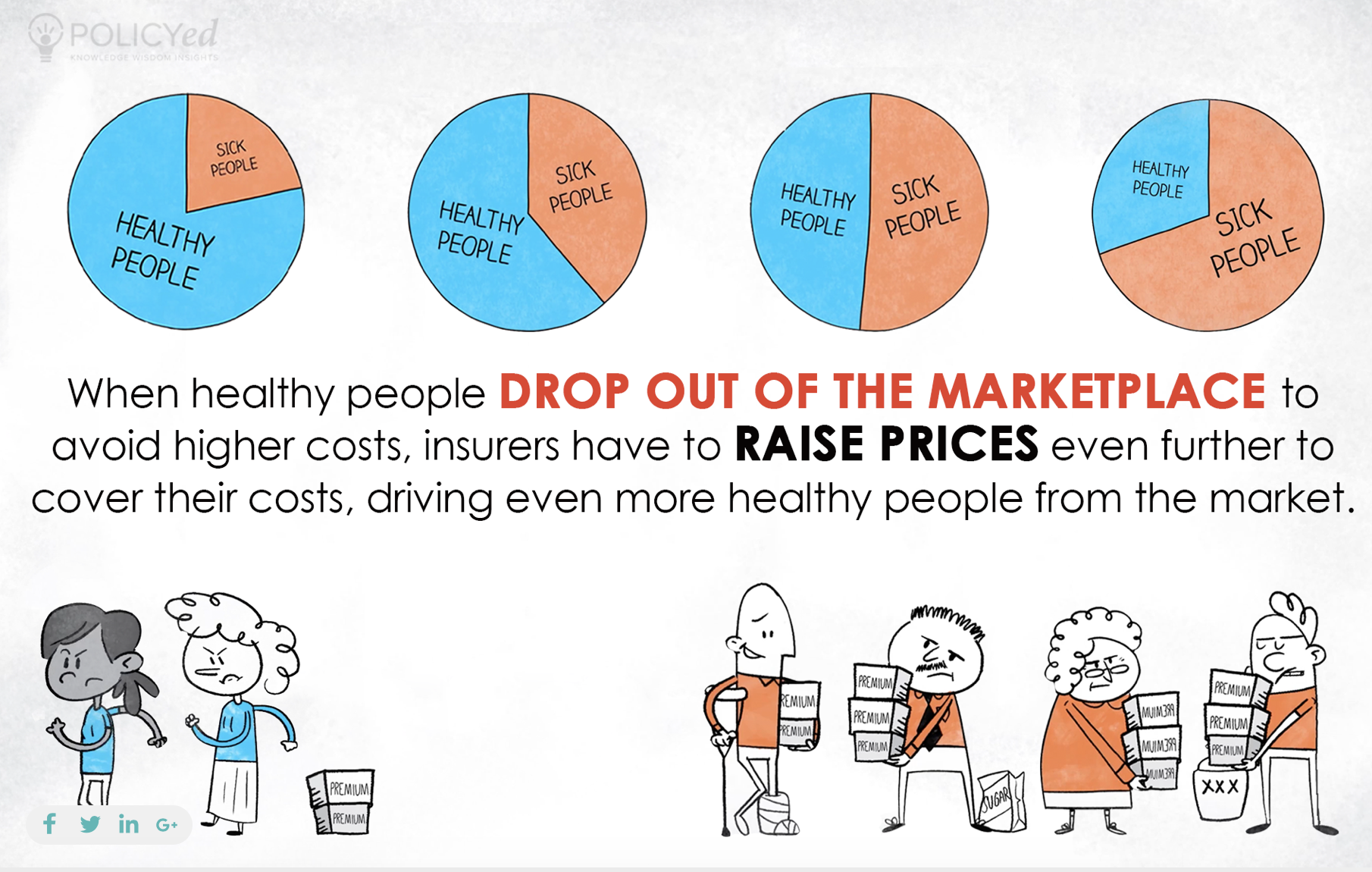

Since insurance is based on spreading out the danger amongst many individuals, it is the pooled cash of all people paying for it that allows the firm to build properties and cover cases when they happen. Insurance coverage is a service. Although it would be wonderful for the business to simply leave rates at the exact same degree all the time, the reality is that they have to make enough cash to cover all the prospective claims their policyholders might make.

7 Easy Facts About Paul B Insurance Described

Underwriting changes and price rises or declines are based on outcomes the insurance coverage business had in past years. They sell insurance from only one firm.

The frontline people you deal with when you acquire your insurance coverage are the representatives and also brokers who represent the insurance policy business. They will certainly describe the sort of items view publisher site they have. The restricted agent is a rep of just one insurance business. They an acquainted with that business's items or offerings, yet can not talk towards various other business' plans, prices, or product offerings.

How much danger or loss of cash can you assume on your own? Do you have the cash to cover your prices or debts if you have a mishap? Do you have unique demands in your life that need extra protection?

Some Known Questions About Paul B Insurance.

The insurance policy you require differs based upon where you go to in your life, what sort of possessions you have, as well as what your lengthy term goals as well as responsibilities are. That's why it is crucial to make the effort to discuss what you want out of your plan with your agent.

If you obtain a car loan to get an auto, and after that something happens to the car, gap insurance will repay any kind of part of your financing that typical auto insurance policy doesn't cover. Some lenders need their debtors to carry gap insurance policy.

The main purpose of life insurance is to provide cash for your recipients when you pass away. However exactly how you die can identify whether the insurance provider pays out the death benefit. Depending on the sort of policy you have, life insurance policy can cover: Natural deaths. Dying from a heart strike, condition or aging are examples of all-natural deaths.

The Best Strategy To Use For Paul B Insurance

Life insurance covers the life of the guaranteed person. The insurance holder, who can be a various person or entity from the guaranteed, pays costs to an insurer. In return, the insurance company pays out a sum of cash to the beneficiaries provided on the plan. Term life insurance coverage covers you for a duration of time chosen at acquisition, such as 10, 20 or thirty years.

Term life is prominent since it uses huge payments at a reduced cost than permanent life. There are some variants of typical term life insurance policies.

Long-term life insurance coverage policies build cash worth as they age. The money value of whole life insurance policy plans expands at a set price, while the cash value within global plans can vary.

basicsPaul B Insurance Things To Know Before You Buy

$500,000 of whole life coverage for a healthy 30-year-old lady costs around $4,015 yearly, on average. That very same level of protection with a 20-year term life plan would cost a standard of about $188 each year, according to Quotacy, a brokerage firm.

hop over to here

Variable life is one more permanent life insurance alternative. It's a different to whole life with a fixed payout.

Below are some life insurance policy fundamentals to aid you better comprehend how insurance coverage functions. Premiums are the repayments you make to the insurance provider. For term life policies, these cover the expense of your insurance policy and management expenses. With a long-term policy, you'll likewise be able to pay money right into a cash-value account.

Report this wiki page